milwaukee tool reviewer

milwaukee tool reviewer

something we need to understand is; a book entry system is not illegal. a book entry system is valuable in certain aspects. some software systems government agencies use are considered book entry systems. such systems are fine for private business or contracting, or even government work. however, the book entry system which we bring attention to is an electronic registry, a national book entry system which cannot replace a the duties of the county clerk. a private registry is not a notice to the public. constructive notice resides with the clerk of the county, or the secretary of state. secured creditors have known this act of filing for perfection for a long time.

it was simple; when the secured real estate mortgage was transferred to other parties after origination, and during each stage of securitization, many requirements according to law were not met to achieve the overall outcome for the "trust". perfection of the security instrument.

milwaukee tool reviewer

that is except for the "national book entry system" as defined by the federal reserve, or securities and exchange commission. the electronic registry used for supposed real estate mortgage loans is not defined in either of the fed's definitions. so, how did the electronic registry for registering transferable records become known by the word defined in (78r)h.b. 1493? "book entry system" means a national book entry system for registering...." was it stephen c. porter's idea? were the elected officials misled? paid off? why didn't they just use "national book entry system" instead of being so specific, and narrowing it down? look up the history of (78r)h.b. 1493, you may find porter was a "witness" in the process of making the intangible part of chapter 51, of the texas property code. you know, the man from the law firm that just makes documents up? i've previously written about this paricular house bill, and the making up of documents, a few years back. i hope you soon wake from your slumber, and understand the illusion you've believed in for so long.

milwaukee tool reviewer

i am not speaking enotes, a student and teacher educational website founded in 1998. i am speaking of the electronic registry "enote". this is a term utilized for the purpose of misunderstanding by the banking industry. no offense to public banking. in order to understand this, you need to look at the law that governs the registry system, esign. i hope the college guys don't mind, and to let you know, they do not endorse this site because i send you there. but, they do have a great library. read about esign and understand what i am trying to explain to you because "holder" is not a word defined in esign. in fact, you will find definitions in the various section but you will not find holder. you will find the definition of "control". this is found in 15 usc 7021(b). when you read the definition, it will help latter on in this explanation. go back to it if you don't understand. it is important you do. the electronic record being created to register in the electronic registry is defined as a "transferable record". you can find that in 15 usc 7021. that is the focus of what is being used in the private registry system. some call it mers.

milwaukee tool reviewer

for the parties privy to the electronic registry in question, it is an easy way of tracking rights to a transferable record. that electronic contract is governed by a law different from real estate law, or contract law, as most used to understand it. nonetheless, this tracking in the electronic registry is used by registry "users" defined as a certain type of "servicer" for the transferable record, tracking beneficial interests in the transferable record. the private registry definition of servicer is different from the public definition of mortgage servicer in 51.0001. esign does not define "servicer". for some strange reason the transferable record is called an enote. and all of that is ok. nothing illegal there. if there is, leave it to the state, or the department of justice.

milwaukee tool reviewer

let us focus on the problem with using an electronic registry for the purposes of real estate mortgages. although real estate mortgage loans were registered into an electronic registry, and a deed of trust was filed originally to establish the constructive notice for a secured real estate mortgage loan, somebody seems to have forgotten a lot of steps in the process of securing the tangible note during the selling, assigning, or transferring of secured real estate mortgage loans through the electronic registry. for instance, if the transferable record tracking system reflected the transfer of rights, these "rights" were transfers of intangible rights. in other words, these "rights" could be payment streams from monthly payments of real estate mortgage loan borrower's.

milwaukee tool reviewer

here seems to be the problem. many assume they understand. you can't do that. focus on esign, or ueta which are the laws governing the electronic registry, and its intangible transactions.

parties who are "members" of the private registry system are considered participants at various levels of the electronic registry which is actually a private registration system tracking private member transactions. some are considered the person in control of the transferable record. this is defined in 15 usc 7021(b). what this basically means in the privae registry system is "he whom holds the transferable record, controls the transferable record". they claim it is an enote but, it is not an enote. it is a transferable record. an electronic record holding information an digital images.

milwaukee tool reviewer

a transferable record is registered into the private registry system by its member;

the intial registration of the transferable record would reflect the transferable record being registered is te authoritative copy. it is supposed to equivilent to the "original" transferable record.

the transferable record is transferred to another private registry system member;

according to 15 usc 7021(b); a person has control of a transferable record if a system employed for evidencing the transfer of interests in the transferable record reliably establishes that person as the person to which the transferable record was issued or transferred.

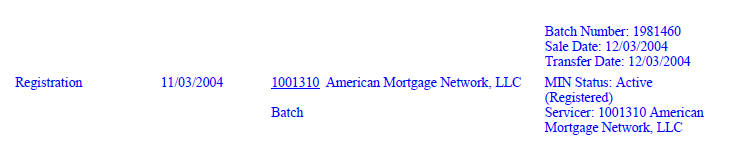

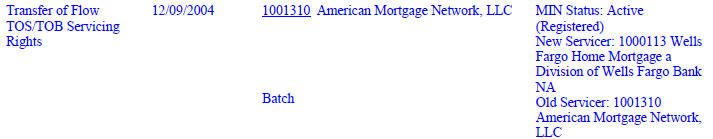

so, according to the description at the right side of the images, the transferable record is an intangible obligation being serviced by american mortgage network, llc. at the time of registration of the transferable record. the next image reflects the transfer of servicing rights (toc), and transfer of beneficial rights (tob) of the transferable record. these are transfers of intangible rights in the transferable record.

this reflection of a transfer of the interests in the transferable record is in private record. this can only be traced via the electronic registry. it is not associated with the transfer of real property rights. it is a transfer from one private member to another private member. to reflect a secured creditor of the real estate mortgage loan, though it may be privately registered in a private registry system, a financing statement (ucc-1)would be required within a 20 day timeframe with a secretary of state. then the secured would file a transfer of lien with the county clerks office in the county where the real property is located.

milwaukee tool reviewer

in order to sync the transfer of the intangible rights of the controller of the transferable record, to a subsequent purchaser for the transfer of servicing or beneficial interest rights in the transferable record, the controller of the transferable record would also need to be the holder and owner of tangible rights to the paper note, secured by a deed of trust, as reflected in county public records, somewhere in texas. this "secured debt" would be held by the secured "whomever". filing in county clerks records provides for constructive notice.

however, keep in mind, this transferable record is only an intangible asset registered in a private registry system. it is not the real estate mortgage loan itself.

this does cause confusion because of the "servicer". it is possible the servicer who may service the transferable record, may also service the secured real estate mortgage loan.

notice, this scenario also reflects two different actions that should be conducted according to each governing law, or private contract. since the secured "whomever" will assign, transfer, or sell the secured real estate mortgage debt, s/he would perform the "passing the chain" ritual, and provide to the subsequent purchaser an endorsed note to the purchaser, and provide such purchaser a transfer of lien to be recorded in public records where the real property is located. at this stage, there is a "temporary perfection" to the secured real estate transaction. but only for a short time.

milwaukee tool reviewer

secured parties are well aware of article 9, secured transactions. secured parties are well aware of "time to perfect" to protect their property, else someone else may bump them out of line. once the transfer of the lien is filed by the subsequent purchaser, public record reflects a "continued" chain of perfection to the secured debt, which is constructive notice. if the secured debt is assigned, transferred, or sold again, the "passing the chain" ritual would take place again to reflect a perfected chain of title in public records. and so on, and so on. this may continue through the life of the secured indebtedness, or it may not.

milwaukee tool reviewer

so, you would think every time an audit is conducted to determine the "transfer of rights" of the transferable record from one controller to the other, there would be a parallel record in public records? hence synchronization of securitization. not necessisarily.

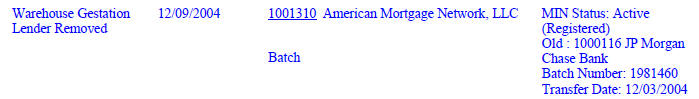

because of the securitization process, other unknown private parties may be involved. however, the only way this would be discovered is through discovery process, or subpeana. take for instance, a gestation lender may need to be removed after the account debtor has fulfilled its electronic obligation to that private member.

so, in this image, jp morgan chase bank, the gestation lender, was removed from the private transferable record. so, there may be actions taken place in the transferable record, but those are intangible actions, not real property mortgage actions.

milwaukee tool reviewer

understandably, private parties using an electronic registry for tracking the transferable record does not replace the texas two step of the "secured" creditor party to the intangible rights, recording a ucc 1 filing statement with the secretary of state, to reflect the perfection of secured assets, but also filing of public records in the county where the security instrument is recorded to reflect a continuous perfected chain of title to the secured debt. else, all is lost for the secured indebtedness, leaving only the personal property, if lawfully produced.

milwaukee tool reviewer

if this transfer of lien is not from an electronic registry, but from the "secured" creditor, the transfer of lien would be governed by the statute of frauds. the document is tangible. the governing laws have resided in the law statutes for along time, and creditors securing their loans have been around for a long time.

milwaukee tool reviewer

the electronic registry, nor its electronic records are governed by the statute of frauds. so, converting an transferable record for the purposes of real estate has no law to support the copy of the electronic record being converted other than what is offered in esign, or ueta.

milwaukee tool reviewer

so, if understood, the transferable record is an agreement between the parties whom agreed to conduct contracts electronically. the legal effect of the converted transferable record only belongs to parties of the electronic contract. the copy of the converted electronic record is not governed by the statute of frauds either.

milwaukee tool reviewer

the transferable record is considered "intangible". it is very important that we understand this matter and not stray from our goal of encouraging the elected officials of the state of texas to resolve the constitutional problems.

this all may seem a bit confusing to many, but the easiest way to understand is go read esign. if you are in texas, read texas ueta, chapter 322, in te texas business and comerce code. i truly believe that once you do, you will see how the texas property code actually contradicts itself. you will recognize the "intangible" statements in it.

milwaukee tool reviewer

so, what is the law of negotiability governing the transferable record, called an enote?

milwaukee tool reviewer

thank all of you for supporting this cause. i hope you sign the petition to help resolve this matter in texas.

sign the petition? i recently signed the

petition "texas legislature: remove "51.0001(1) "book entry system" in

texas property code" and wanted to see if you could help by adding your

name.